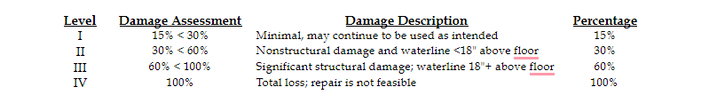

The Tax Code Section 11.35 allows a property that is damaged at least 15% and up to 100% in a Governor declared disaster area to receive a temporary exemption of a portion of the appraised value of the property. A property owner must apply for the exemption no later than 105 days after the governor declares a disaster area (Hurricane Laura declaration was 8.23.30 with an application deadline of 12.7.2020 and TS Beta declaration was 9.21.2020 with a 1.4.2021 deadline). The exemption is automatically available to residents of the City of Friendswood, Dickinson, Hitchcock and Jamaica Beach and properties in MUD 12 (Bayou Vista). The exemption has been adopted by Galveston County (including Road and Flood), Galveston, Kemah and will be considered by Hitchcock ISD next week. Friendswood ISD considered the exemption at a meeting Monday night but no word has been received regarding the status of adoption. Qualified property includes personal property used for income production, improvements to real property and certain manufactured homes. Property owners must submit documentation (from FEMA, insurance company, an office of emergency management, or other reliable source) along with the application (available online at www.galcotax.com on the homepage under Hot Topics). The chief appraiser must send written notice of the approval, modification or denial of the application no later than five days after making the determination. The exemption expires January 1 of the first tax year in which the property is reappraised thus would not apply to property values in 2021. Applications and documentation should be mailed or emailed to the appropriate county appraisal district as follows: Galveston CAD 9850 EF Lowry Expressway Texas City, Texas 77591 [email protected] Harris CAD 13013 Northwest Freeway Houston, Texas 77040 [email protected] Upon receipt of an application, the chief appraiser determines if the property qualifies for the temporary exemption and assigns a damage assessment rating of Level I, II, III or IV, described as shown below: The damage assessment rating determines the percentage of appraised value to be exempted. The amount of the exemption is determined by multiplying the property value times the percentage of the damage rating and applying the exemption for the fraction of the tax year remaining in the year after the disaster was declared.

Temporary disaster exemptions became law after 85% of Texas voters approved Proposition 3 November 5, 2019 (The Constitutional Amendment authorizing the legislature to provide for a temporary exemption from ad valorem taxation of a portion of the appraised value of certain property damaged by a disaster). The exemption is automatic in the event a government had not adopted a tax rate before the disaster is declared. According to the enabling legislation, a government that has already adopted a tax rate must vote to grant the exemption within 60 days of the disaster declaration. For Tropical Storm Beta, the deadline is November 20, 2020. The deadline to apply for the exemption for the adopting governments is 45 days after adoption, thus deadlines could differ. The Galveston County Chief Appraiser will utilize the January 4th deadline for all applications received from Galveston County property owners. Any and every property owner harmed by Hurricane Laura should apply by December 7th and those harmed by Tropical Storm Beta by January 4, 2021 for this taxpayer friendly temporary exemption.

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed