|

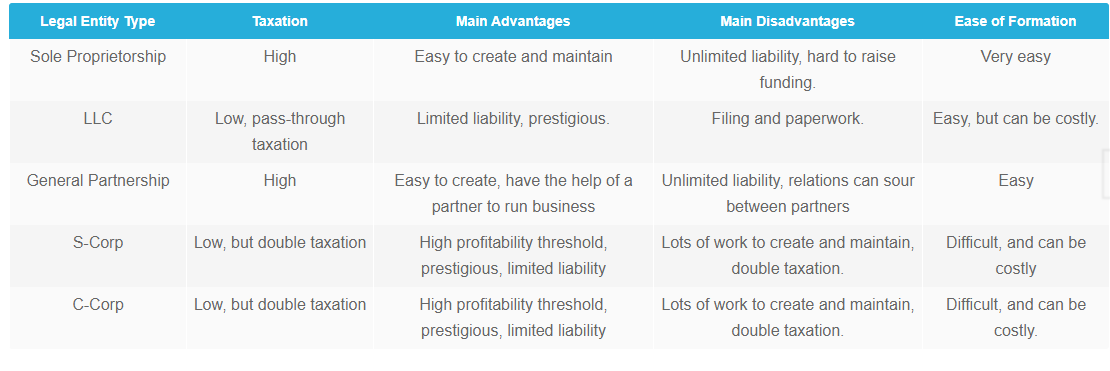

Starting a small business is no easy feat. And it is best made easier by understanding every single step you have to take, in the order you have to take it. The good news is that the process of registration and formation is actually quite straightforward. This step by step guide will help you to do it correctly, without omitting any key details. 1. Understand Your Goals and Ambitions Before you do anything at all, you will have to make sure that you love what you do, and that you are willing to stick with it to the end. You will need to make a list of short-term, medium-term, and long-term goals. While it won’t pan out exactly as you expect, it is still always useful to make a template and to visualize where you want to go. If you do not have the necessary passion to succeed over the long-term, then there is no point in entering the business! You can’t enter it purely for profit, either. It could take years to make a serious profit, and you want the process to be enjoyable. Have a clear plan of your goals and expectations, and where you intend to take the business in the future. 2. Choose a Business NameBefore you do anything, you need to choose a business name, once you have an idea. This is pretty straightforward, but you need to ensure that the name is available and that the business name is an accurate description of what you are supplying. To check business name availability, go to your department of state website. When you are on the website, just check the business name availability. Make the search as broad as possible, and leave out any punctuation. For example, you might want to type in ‘Johns Electrical’ instead of “Johns Electrical Services Limited”. Leave the query broad so you can see all the similar business names. You don’t want duplicates and want your name as original as possible. Make sure the name is unique and that it describes your business activities. It’s also helpful at this stage to make sure that there is a domain name available, but don’t get hung up on this. The business name is more important and you can get creative with domain names later on. If you want to do business in another state, then you need to apply for a DBA or fictitious name. This will follow a similar process, but you will need to pay a fee to do business in a different state. You will need to make sure the business name is available in that state too. You don’t need to concern yourself with this starting off, but it’s something to keep in mind. 3. Market ResearchUndertaking market research is largely overblown. There are tonnes of online articles stipulating how important it is. But market demand is created by good small businesses where this demand does not exist before creation. A town without a pizzeria might not have a high market demand for this place if the population was surveyed. Yet if the pizza outlet is established, then the food type would be brought to the customers’ attention. High quality of service will often generate demand. Of course, market research has its place, especially in certain industries. But don’t let it prevent you from opening up your small business and don’t get too hung up on the figures. If you are passionate about your model and stick with it over the long term, then the demand will be created and the customers will respond to the quality of your goods/services. At the same time, there is no need to open up a business in an industry that is completely saturated, unless you are doing something completely different. 4. Selecting a Business StructureSelecting a business structure (i.e. legal entity type) will have a profound effect on the control you have over the business, what taxes you can pay, and on the day-to-day running of your organization. There are numerous types to choose from, but small businesses will generally fall into three main categories – the Sole Proprietorship (‘SP’), the Limited Liability Company (‘LLC), and the General Partnership (‘GP’). One of the most common paths is to start off as a Sole Proprietor initially. Down the line, you can form an LLC for tax and/or sales purposes. But you can also start off as an LLC if you wish – there are many single-member LLCs with one business owner. It is a very popular model. A corporation is never really referred to as a ‘small business’. If you run a small freelance business without registration, then you are automatically classified as a Sole Proprietorship by the IRS, and need to pay taxes accordingly. The same can be said of a General Partnership, though this will invariably have a partnership agreement to outline the roles and responsibilities of each partner. 5. Registering and Forming The Business Once you already have a business name and you know the legal entity structure, it’s time to register the business in the state where you will be operating. This is easy, but there are different processes depending on whether you are starting a Sole Proprietorship, General Partnership, LLC, or Corporation.

Like the EIN number, a business bank account is also necessary for day-to-day functioning and for tax/legal reasons. A Sole Proprietor will need to show an EIN and SSN number, similar to the General partnership. A Corporate account will need to provide the Certificate of Incorporation and an LLC account will need to provide the Articles of Organization, in addition to the EIN number. 7. Make a Business PlanThe business plan is very important for a small business. If you are pitching for a loan or venture capital, then you need to have a business plan. But even if you are not looking for this type of capital, it is best practice to have a professional business plan. It will outline the ethos and goals of the company, as well as what the company hopes to achieve. If you are new to the world of business, writing a business plan is a great way to understand some of the mechanics of the industry. The plan does not have to be huge, and you are wasting your time with a 40-page business plan. 10 pages should be more than enough, where you cover the market need, budget, expansion, business goals, and other essential details. Nearly all business plans will incorporate:

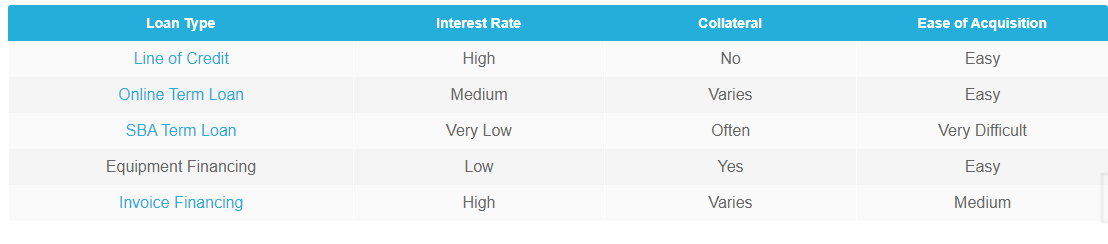

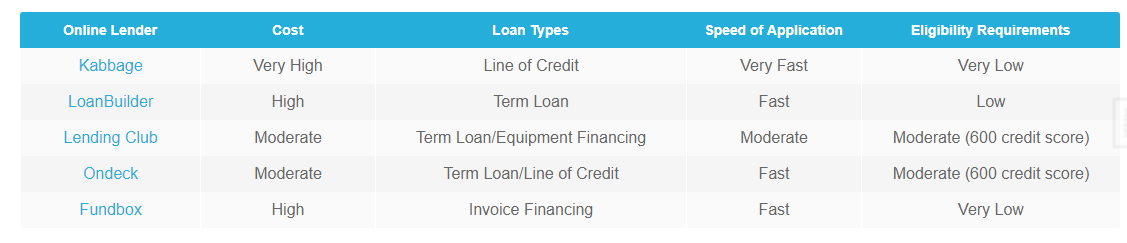

Yet in most instances, a small business loan from a good lender is mandatory. One turn of the market can ruin an excellent business that does not have capital at hand to weather the storm. There is little point in starting a business if it cannot be sustained with money over the long-term. Which is why small business owners need to give serious consideration with regard to how they will be funding their operations. Below, some of the major loan options are explored. 9. Find a Good Online LenderOnce you have decided what kind of loan you want, the next step is to find the right lending platform. For the vast majority of small businesses, startups, and freelance enterprises, an online lender is superior to banks and other financial institutions. This is because the application process is far quicker and the eligibility requirements are lower. If your credit score is less than 680, you will have a hard time getting an SBA loan without an excellent business record and/or providing collateral for the loan. Due to this, most new businesses will need to avail of online platforms. The best online lenders are compared below. 10. Attain the Relevant Licenses, Permits & InsuranceDepending on the nature of your business activity, you will need to attain the relevant licenses and permits. Professional services such as legal, accountancy, finance, and medicine are tightly regulated and you will need to get the appropriate certificates and permits. Different states will have different requirements. You also want to consider licenses and permits in relation to your business office, as well as the relevant insurance for employees. Insurance is a huge area that can turn a profitable business into an unprofitable one. The main forms of insurance will include:

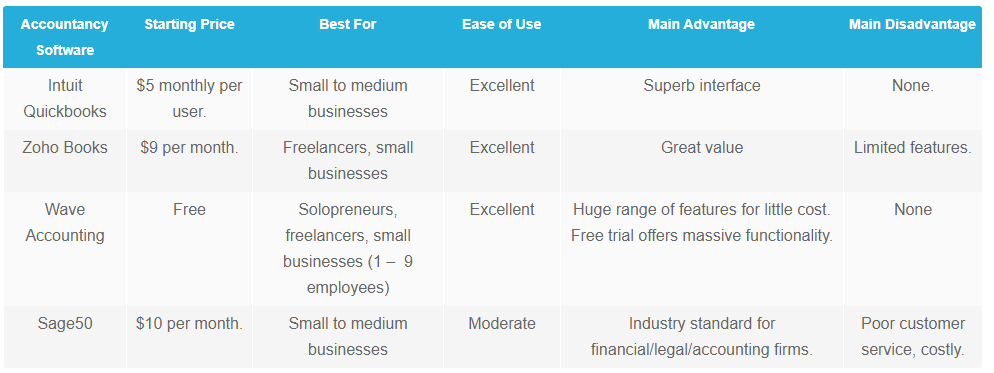

12. Establish a Web PresenceEstablishing a web presence is vitally important, in the digital age of smartphones, voice search, virtual reality products, and other innovations. Most customers are going to find your products/services online. In terms of capitalizing on this, remember that social proofs are one of the best ways to improve business reputation. Sites such as TrustPilot and Sitejabber can really help (or hurt) your business. Building an online presence is not something that is done in a day or even a year. It has to grow and expand with your business. It is part of your business, not something ‘additional’ or ‘separate’ Regardless of what you are selling, make sure that you have a website that looks very well, is easy to navigate, and that has an optimized conversion rate. You don’t have to reinvent the wheel, but you do need to be persistent in all areas. 13. Scale, Automate, and ExpandOnce you have the basics mastered, then you can look toward scaling, automating, and expanding. To do this, you will need to hire more people and network extensively. Hiring the right employees is an art of itself and beyond the scope of this post. But hiring the wrong people can be very costly. If in doubt, wait it out. Many businesses, especially startups, fail due to scaling too early and making the wrong hires, deals, and partnerships. Don’t be too quick to expand unless you know what you are doing. Taking a business from small to medium is a huge step that can lead to disaster if it is not executed correctly. Every part of the business needs to scale at roughly the same rate, to prevent an over extension in certain departments. Automation tools and third-party applications can greatly assist in managing legal and financial duties. For instance, applications such as Turbo Tax can make paying taxes a whole lot easier. It’s important to research the full list of online tools to help small businesses grow and expand. They can reduce your workload extensively at little or no additional cost. RecapTo start a small business, all you need to do is:

Small business owners in the USA are still indicating huge levels of job satisfaction, despite many regulatory and business-related hurdles. It is easier than ever to start a business and join the ranks of happy US business owners. Daniel Lewis Daniel Lewis is an MBA accredited investment professional who wants to assist small business owners to gain access to finance. After going through many channels for funding, Lewis has found that getting the first loan right is vitally important for future success. Shared from https://www.finimpact.com/ Contact Finimpact Abba Hillel Silver Road 7 Ramat-Gan, Israel +972-58-5589170 [email protected]

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed